Our Methodology to raise Capital for your Real Estate Development involves the following steps:

2. Plan

We develop a Capital Raise Master Plan (CRMP) in different versions: bankers, lenders, equity investors and EB-5 investors.

4. Letters of Intent.

We concentrate on obtaining letters of intent from those sources of money to evaluate terms and conditions offered by those sources.

5. Due Diligence.

We help you with the complete due diligence process to validate those sources of capital.

6. Closing

We accompany you during the closing process to make sure that the contracts and all other details are accurate.

WHAT WE DO

CAPITAL RAISING

For Real Estate Developers

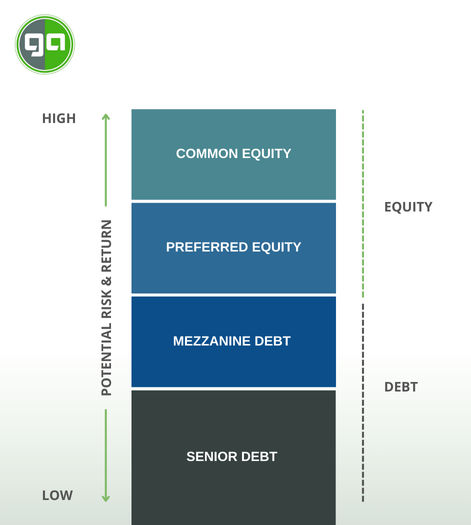

G&A Group offers capital raising services to find the proper debt, equity or mezzanine loans for your real estate development in the US and Mexico. We have money sources from all over the world looking for real estate developments.

If you project has the following, please contact us to help you finding the right capital sources:

1) Land under contract.

2) 15% to 20% of Total Capital Stack.

3) Complete Executive Summary of your Project

- Permits

- Licenses

- Feasibility study

- Market study

- Environmental impact studies

- Financial projections

- Rendering

- Commercialization

- Property management strategy

Real Estate Capital Stack

0

Years

0

Clients

0

Projects

0%

Clients' Satisfaction